The United States Department of Justice has indicted Indian billionaire Gautam Adani on serious fraud and bribery charges. The explosive legal action reveals a complex financial scandal involving solar energy contracts and investor deception.

Federal prosecutors allege that Adani masterminded a sophisticated $265 million bribery scheme. The indictment claims he and his associates deliberately misled investors while raising over $3 billion for renewable energy projects.

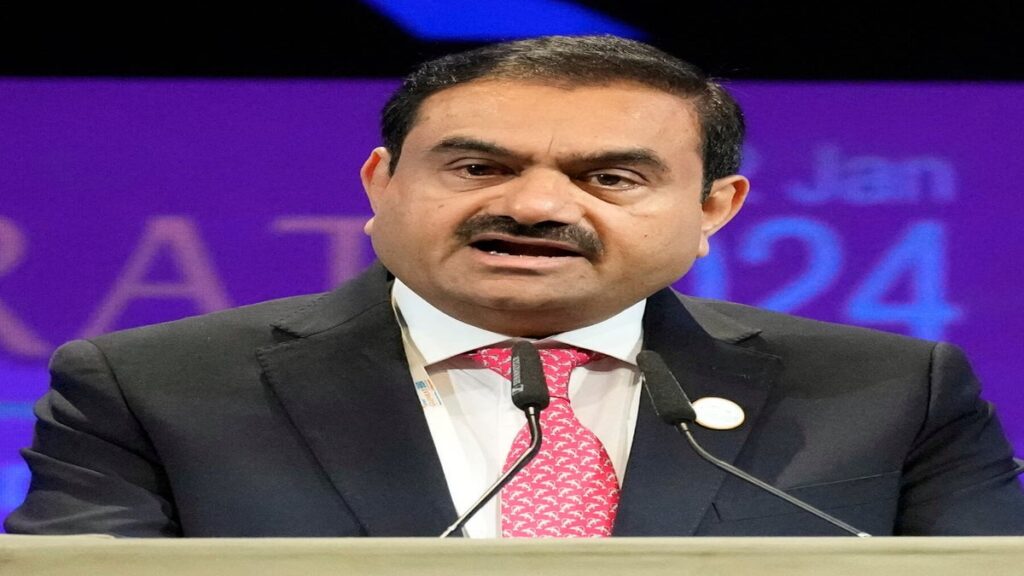

Indian billionaire Gautam Adani.Courtesy photo

Key details of the charges include securities fraud and conspiracy. Prosecutors suggest Adani’s group systematically concealed critical information about their business practices. The allegations strike at the heart of the billionaire’s international business reputation.

The charges stem from Adani’s attempts to secure lucrative solar energy contracts through illegal means. Investigators uncovered evidence suggesting deliberate manipulation of financial records and investor communications.

US legal authorities have been tracking the case for months. Their investigation revealed a pattern of unethical business practices that potentially violated multiple federal regulations. The indictment represents a significant legal challenge for Adani’s global business empire.

Adani Group, the billionaire’s multinational conglomerate, has yet to issue a comprehensive response. Market analysts predict potential significant financial and reputational consequences from these serious allegations.

The legal action could dramatically impact Adani’s international business standing. Investors might reconsider their financial commitments to his various enterprises. Stock markets have already shown initial signs of market uncertainty.

Financial experts suggest the indictment might trigger broader investigations into corporate practices. The case highlights increasing international scrutiny of cross-border business transactions and potential misconduct.

Legal proceedings are expected to be complex and potentially lengthy. Adani will likely contest the charges through high-profile legal representation. The case could set significant precedents for international corporate accountability.

The solar energy sector, particularly renewable energy investments, might face increased regulatory oversight. Investors and industry stakeholders will closely monitor the developments of this unprecedented legal action.

International business communities are watching the case with keen interest. The allegations represent a substantial challenge to Adani’s global business reputation and potential future investments.

The US Department of Justice has demonstrated its commitment to investigating cross-border financial misconduct. Their comprehensive approach signals a robust stance against potential international corporate fraud.

Adani’s legal team is expected to mount a vigorous defense. They will likely challenge the evidence and dispute the specific allegations presented in the indictment.

The case underscores the importance of transparent corporate governance. It serves as a stark reminder of potential consequences for unethical business practices.

Regulatory bodies worldwide might use this case as a benchmark for future investigations. The comprehensive nature of the charges suggests a systematic approach to uncovering potential corporate misconduct.