Governors in Kenya are facing a severe financial crisis. They have threatened to shut down all county operations within 30 days if the National Treasury does not release overdue funds. This alarming situation arose during a meeting of the Council of Governors (CoG) on November 18, 2024.

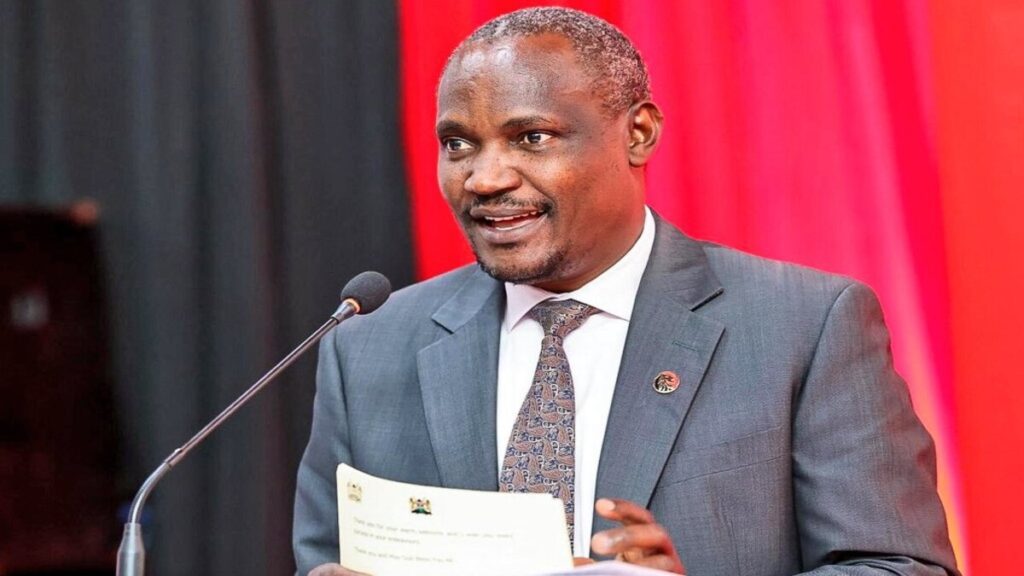

The treasury cabinet secretary John Mbadi in previous events:photo courtesy.

The governors claim that the Treasury owes them Ksh 63.6 billion for October and November allocations. They argue that this delay is unacceptable and jeopardises essential services. Ahmed Abdullahi, the CoG chairperson and Wajir Governor, expressed frustration over the ongoing financial struggles faced by counties. He stated, “We cannot be in November and still be discussing disbursements from August.”

The CoG chairperson and Wajir governor Ahmed Abdullahi:photo courtesy.

The funding crisis has been brewing for months. The financial year began in July 2024, but many counties are still waiting for their equitable share of revenue. The National Treasury has released Ksh 158 billion since July, but governors argue that this is insufficient to meet their operational needs. They highlighted that they have been operating on only 50% of last year’s allocation. This limited funding has made it difficult for counties to provide necessary services to their residents.

In response to the governors’ threats, Treasury Cabinet Secretary John Mbadi insisted that the government has fulfilled its financial obligations. He stated that all funds due until October have been disbursed, except for November’s allocation. Mbadi urged governors to manage their budgets effectively and pay their workers promptly. However, the governors are not convinced by this assertion. They argue that the delays in disbursement are causing significant disruptions in service delivery across the counties. Moreover, they pointed out that while counties struggle with funding, the national government continues to receive its shareable revenue without delay.

The situation has been exacerbated by legislative delays. The County Allocation of Revenue Act has not yet been assented to, despite being passed by both houses of Parliament. This delay has left counties without a clear financial framework for the current fiscal year. The governors are particularly concerned about the National Assembly’s decision to reduce county equitable shares by Ksh 20 billion. They believe this reduction will directly impact ordinary Kenyans who rely on county services.

If the funding crisis is not resolved, counties may face severe operational challenges. Abdullahi warned that by December 2024, the interim arrangement allowing for 50% of last year’s allocation will end. This could lead to a complete halt in operations from January 2025. The governors have called for urgent action from Parliament to address these issues. They want a swift resolution to ensure that counties can continue to function effectively and provide essential services to their residents.

In addition to general funding concerns, governors have raised alarms about outstanding debts owed by the National Hospital Insurance Fund (NHIF). They claim that Ksh 9.1 billion remains unpaid, which hampers healthcare delivery in public facilities across the country. The ongoing budgetary woes have led to fears that devolution itself is under threat. The inability of counties to conduct their mandates due to cash shortages raises serious concerns about governance and service delivery at the local level.

As tensions rise between county governments and the National Treasury, urgent action is needed to resolve this funding crisis. The threat of a shutdown looms large over all 47 counties if Parliament fails to act swiftly. The implications for ordinary Kenyans could be dire if essential services are disrupted.

Governors are calling for immediate disbursement of funds owed to them. They argue that without prompt action from the government, they will have no choice but to halt operations entirely.